March 13, 2024 – 2:00pm-3:15pm EST.

Conversations about money as a family

I really try to encourage more transparency around money and having these conversations with our kids. It doesn’t have to be difficult. And it can start at any age. For example, even young kids can understand the concept of choice and that a teddy bear might cost 15 chocolate bars.

Thinking of money in terms of what it can earn VS what it can buy

This is a critical lesson for being truly financially literate. And most of us miss this critical differentiation. It involves discussions around the time value of money and compound interest and financial freedom. However, I can explain it in a way that even a 5-year-old can grasp the concept. And this is how we shift our relationship with money.

Talking Points

Golden Rule #1: Only buy the awesome stuff

This rule is based around money mindfulness and first understanding what’s truly important to you. This mindset shift is how we stop chasing more and I have a number of examples of how this breaks the cycle of comparison and never having enough.

Golden Rule #2: Always save first

This rule is based on developing the habit of saving. Creating it as a habit rather than budgeting, is how we overcome our tendency to spend what we have. And is the easiest way to actually save without constantly thinking about it.

Golden Rule #3: Send your money to work today

This is rule is based around the idea of compound interest. You don’t need to understand all of the details around investing. More important is understanding the concept of compound interest and that your money can earn money for you. This is how you create intergenerational wealth that will last forever.

Golden Rule #4: Give and you’ll have more

This is a rule based around the idea of giving and how that will actually make you richer in many ways, including financially.

David Delisle

David Delisle, founder of The Awesome Stuff™, is an Amazon bestselling author, entrepreneur, real estate investor, speaker, and most importantly, Dad. He is a contributor to Entrepreneur, Yahoo! News, Business Insider, Thrive Global and more.

At age 11, David made his first investment. By 20, he began investing in real estate and was retired by 40.

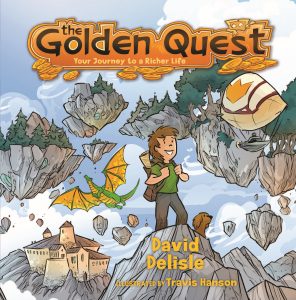

His book, The Golden Quest, is a Calvin & Hobbes-style graphic novel that teaches powerful lessons about money, focusing on breaking the cycle of always chasing more.

David’s goal is to change the way our kids think about money and create more freedom for what’s most important to them… the Awesome Stuff™.

Instagram: @theawesomestuff

TikTok: @theawesomestuff

YouTube: youtube.com/@theawesomestuff

Website: www.theawesomestuff.com

Book: The Golden Quest www.amazon.com/Golden-Quest-Your-Journey-Rich/dp/1777718902